Definition: Payments consisting of both a principal and an interest component, paid on a regular basis during the term of the mortgage. Refers to how often and when you can make these payments.

Options:

- Monthly (any day of the month usually between the 1st and 28th )

- Weekly (any day of the work week, 52 payments per year)

- Bi-Weekly (every other week, 26 payments per year)

- Semi-Monthly (twice per month, 24 payments per year, e.g. on the 1st and 15th of each month

- Plus accelerated weekly and bi-weekly

What is an accelerated bi-weekly payment?

- Accelerated Bi-Weekly payments are exactly half of a regular monthly payment amount BUT it is collected every two weeks

- This means you make 26 payments per year

- For example, if the monthly payment is $1,000 then the accelerated bi-weekly payment will be $500

- If you paid monthly you would pay $1,000 x 12 months = $12,000 per year

- Paying accelerated bi-weekly you would pay $500 x 26 = $13,000 per year

- This results in you paying an extra $1,000 off your mortgage each year – hence accelerating how fast you pay it back!

- Remember, twice a year you will have three payments in one month

- Accelerated weekly refers to monthly payment divided by 4!

What is a non-accelerated bi-weekly payment?

- Non-accelerated is taking the regular monthly payment and times by 12 months, then

- Divide this into 26 payments

- For example, if the monthly payment is $1,000 then the non-accelerated bi-weekly payment will be $461.54

- If you paid monthly you would pay $1,000 x 12 months = $12,000

- Paying non-accelerated bi-weekly you would still pay $12,000 = $461.54 x 26 = $12,000

- This results in you not paying any extra off your mortgage each year – hence non-accelerating

- Remember, twice a year you will still have three payments in the one month

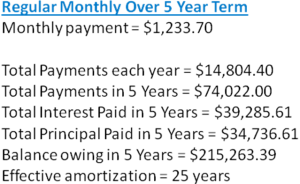

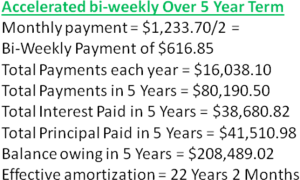

So let’s compare the payments and savings between these two options; regular monthly and accelerated bi-weeklypayments:

$250,000 mortgage with a 25 year amortization at 3.39% 5 Year Fixed Term

The real difference is YOU paid an extra $6,168.50 off your mortgage which took 2 years and 10 months off your mortgage and saved you $604.79 in interest

So how do you select the right one for you?

- Determine which payment option you actually qualify for

- Review what payment options the lender offers

-

Consider aligning your payment frequency with how often you get paid each month e.g. if you are paid every two weeks, then consider accelerated bi-weekly payments to align with each pay cheque

- The more often you pay, the less interest you will pay

-

You can always adjust this at any time and change

My recommendation: Pay accelerated bi-weekly if you can afford it, as it forces you to pay more. By paying your mortgage off sooner you will reduce your debt and save unnecessary interest – plus a forced savings plan for the future!